At Americas Driving Force, we reach over 10,000 drivers per month and the #2 question (if you guessed salary as the #1 question you are correct) they ask when considering a driving job is “What are my Health Benefits?” For this topic, we connected with Mitch Bales of Holmes Murphy to help us write this contribution. Mitch prides himself on deploying custom solutions that bring his clients real results. (Ask him how he saved a trucking company over $700K recently).

With health Insurance being some drivers’ largest deduction from their paycheck, it is crucial to know exactly how to highlight this benefit to attract top talent. And IF your benefits aren’t setting you ahead of the competition it may be time to consider what that’s costing you in driver recruiting and retention…but not to worry, there ARE solutions.

Drivers care about what health benefits are offered at your company before they even consider taking a job. Which makes sense right? We have found that very few trucking companies are really using this to sell drivers on their company. Even some clients that are offering fantastic benefits are NOT highlighting them.

In this contribution, we are going to help you with:

- One super simple way to use a visual graphic to attract new drivers is by showcasing your benefits on your very first call.

- A new solution you can consider to enhance your benefits and beat your competition in recruiting.

- A key discovery that saved one of Mitch’s clients over $700,000 in 2 years (which they were able to use to enhance their drivers’ benefits and retain and recruit better)

“When we do this, companies are more profitable, grow at a faster pace than their competition, and attract and retain top talent to their companies.” explains Mitch.

1. The first thing you will need is a graphic that allows you to showcase your benefits plan on the first call with your driver. You can text or email it to them so they can understand it clearly. We have provided this template for you to make it easy. Download a sample here: “As a bonus tip, make sure every driver in your company gets this graphic annually to remind them of all that your company is doing to show you care about your drivers. This will greatly help with retention!” says Mitch.

Want an editable version of the Benefits Plan? Contact us to request it.

2. Secondly, one of the most flexible solutions, that may be new to you, is Captive Insurance plans. We will cover what a captive is, why it’s important, and why they are particularly important for trucking companies when it comes to the benefits you offer drivers. This will give you another great way to brag about your company in a meaningful way when talking to potential hires.

What is Captive Insurance?

A captive is a licensed insurance company fully owned and controlled by the member companies that qualify. In contrast, with traditional insurance, you are at the mercy of 100-year-old carriers who continue to offer the same solutions with double-digit increases year after year.

What this means in layman’s terms is that you are joining forces with other like-minded companies who value the same things you do. The historical data on Captives speaks for itself showing the rewards of lower healthcare costs, and more control which provides greater transparency on where your dollars go. In a captive, you may take on a slightly higher risk but you can substantially lower insurance costs in comparison to premiums paid to a commercial insurer. Most importantly, the captive can provide coverage that is unattainable in the private market and bring solutions to the pharmaceutical costs that trucking companies battle due to their unique demographic.

Why is Captive Insurance Important for You?

The average annual increase in the private or traditional market is 12-15% while the average increase in a common captive is 5%. This means that company A which has traditional increases over a 5-year period would pay out 60%+ while company B which has Captive insurance would pay out 20%+. This is a huge deal because trucking companies with Captive Insurance programs can reward their drivers by sharing in these savings through bonuses at the end of each insurance term and/or lowering overall employee costs of benefits. It’s a win for all.

Why is Captive Insurance particularly important for trucking companies?

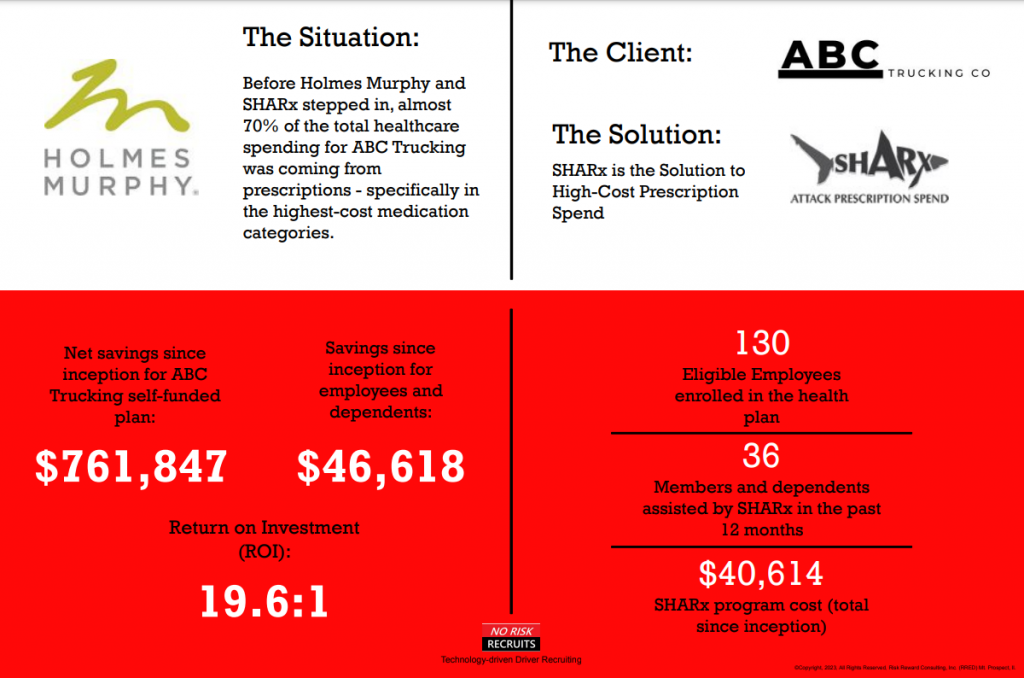

While the lower renewals are significant, where trucking companies may see their greatest financial impact is in lower pharmaceutical costs. Let’s face it, one thing all trucking companies have in common is that their employees sit a lot and most don’t have the luxury of gourmet meals on the road. “Captive insurance is able to offer unique solutions that help drive costs down by hundreds of thousands of dollars a year in the case of one of our clients…yet another pool of money to use in your recruiting and retention efforts to show up in a big way for your drivers” mentions Mitch Bales.

3. As we’ve been discussing with our expert contributor, Mitch Bales, trucking companies have some unique challenges when it comes to health benefits. The greatest of these is the demographic of truck drivers. With the stress of their job and the long hours sitting, truck drivers are a high-cost population to provide health care for. While most companies see their greatest cost on the medical side, trucking companies see their greatest cost on the pharmaceutical side. The average company will spend 80% on medical, and 20% on pharmaceuticals. In trucking, you can practically almost reverse these numbers.

So what can trucking companies do?

The first thing to do is to work with your broker to identify your pharmaceutical trends and see what alternative solutions are out there. If you are in a captive or looking to join one, there are some unique solutions available to you. One of these solutions is SHARx which is shining a light on BIG PHARMA’s extreme costs by providing a way that employees can obtain the same prescription drugs for 50-70% less than they are today. With SHARx you are able to keep all employees on low-cost medicines on your existing plan but add SHARx on for high-cost medicines over $250. SHARx does all the outreach on behalf of your employees to procure these EXACT medications (even brand names) in ways that traditional plans cannot. What this means for your truck drivers is that many of them get these high-cost medicines for free or at a large discount. This also means that the company is not getting charged these high prices which drive up their premium costs and renewals.

This strategy is something most companies have NEVER been told about by their broker. Our goal here is to introduce you to the concept. The graphic below has real numbers from one of Mitch’s clients in the trucking industry. It goes without saying that if you can save a driver’s family several thousand dollars per year, you are going to have a driver who stays with your company.

Contact Mitch Bales from Holmes Murphy